Options are derivative instruments that give the holder the right, but not the obligation, to buy an underlying security. You can trade options by paying or receiving a small premium known as an “option premium.”

“Call options” and “put options” are the two types of options that can be used for various purposes, including generating income, hedging your portfolio positions, and even speculation. Options can have many asset classes as their underlying securities, such as equities, indices, commodities, currencies, interest rates, options on futures, etc.

Option structures vary from simple to complex, requiring greater analysis and expanded access to advanced technical tools. That is why you need an options trading app that is distinct from a stock trading app.

What’s the Need for a Dedicated Options Trading App?

1. There are Different Types of Options

Options vary from simple to complex or combinations of two types of options. Examples include the following:

- OTC options, exchange-traded options

- By expiry, they are classified into weekly, regular, quarterly, and long—term expiration options.

- They are classified into the binary, barrier, compound, and non-standardized options by complexity.

2. Options Have Two Distinct Components

Time value of money and intrinsic value. The time value of money perishes rapidly as maturity approaches. Options are calculated using complex formulae, which are designated by the number of Greek letters.

That is why a specialized options calculator is required on a specially designated options app that can quickly estimate both the risk and option portfolio positions. Other apps, like equity trading apps, do not have such specialized calculators.

3. Options Require Advanced Technical Charts

An options app displays different technical charts so that the options trader may have a better chance to profit from options trading. Options traders need to know how to read such technical charts to trade better.

Usually, these include charts that compare stock price movements to option price movements. Option charts tell a unique story about trading put and call options. A lot of practice goes into learning these charts before you can understand them perfectly.

4. Options Trading Needs Different Parameters

Many parameters, such as option expiration dates, strike prices, open interest, bid/ask prices, and options calculators, encompass all the option equations, which are not available in any other app.

These are some of the distinct and unique features that must be present on the dedicated options trading app you choose.

How to Choose a Dedicated Options Trading App?

The following are the ways you can choose a dedicated options trading app:

- Choose a SEBI-regulated broker who provides a dedicated options trading app with all the above features.

- The options trading app chosen should enable you to gain exposure to different asset classes which have hitherto been outlined. It should be versatile in allowing you to trade in other asset markets.

- The brokerage fees and any charges for the options trading app must be minimal. This will help you to maximize your return while minimizing your costs.

- The app should provide a robust options trading platform with access to all the research tools and advanced analytics. An options calculator is a must.

- The app should have all the advanced technical charts to facilitate your option trades. Various studies to analyze complex options should also be featured here.

- The dedicated options trading app should have an easy user interface that you can easily understand.

- The app should also be usable on different devices like desktops, laptops, and mobile phones, so you can trade options even on the go.

Key Takeaways

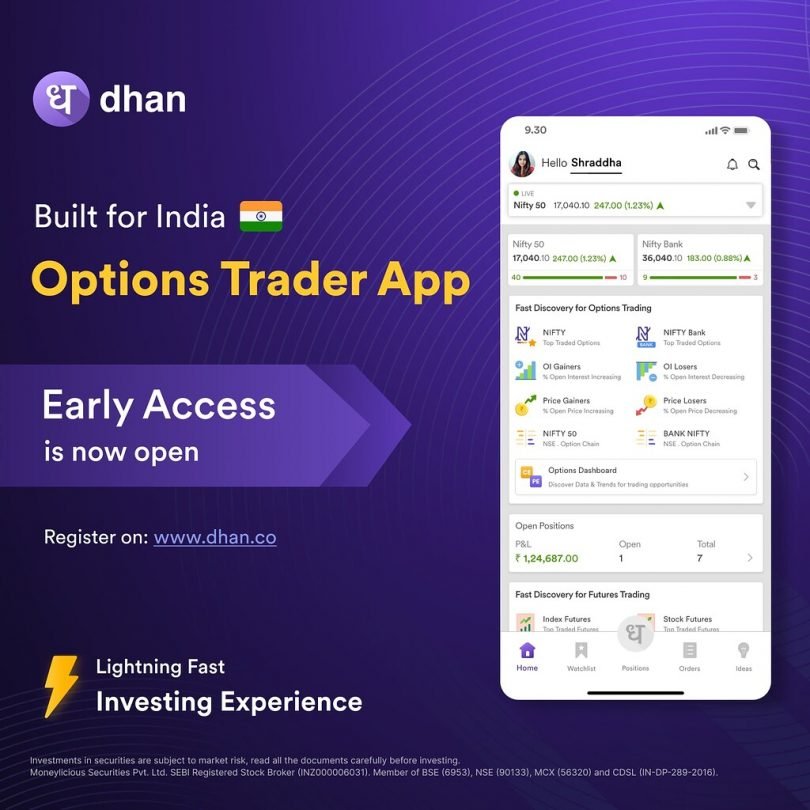

When you decide to start online option trading, ensure that the trading app your broker provides has all the above features. Check out the Dhan options trading app as it is a versatile options trading which will provide a great start to your options trading journey.

Disclaimer:This blog is not to be construed as investment advice. Trading and investing in the securities market carries risk. Please do your own due diligence or consult a trained financial professional before investing.