According to the Credit Suisse Global Wealth Report 2022, there were an estimated 62.5 US dollars millionaires at the end of 2021. Millionaires in the United States accounted for 39.2% of the world’s total, with a record increase of 2.5 millionaires from the previous year. The average wealth per adult also rose to USD 87,489 from USD 79,952 at the end of 2020.

If these statistics have you thinking, “How can I build up wealth?” read on. This article will explore four wealth-building strategies to secure your financial future. Let’s get started.

Set Financial Goals

Setting financial goals is essential for building wealth, as they provide a clear vision of your goal. Your goals should be SMART, i.e., specific, measurable, attainable, relevant, and time-bound. So instead of just vowing to save each month, you commit to, for example, setting aside $3,000 in 12 months for your emergency fund.

“It takes as much energy to wish as it does to plan.“

― Eleanor Roosevelt

Once you define your financial goals, you can create a plan to achieve them. A financial plan includes actionable steps such as making a budget and living by it, paying down debt, and getting a side hustle. Regularly review your progress, and make adjustments as needed.

Increase Your Income

The more money you make, the more you can save and invest. There are three main types of income:

Earned Income

Earned or active income is the money you earn from a job, business, or profession where you’re an active participant. It takes many forms, including salary, wages, bonuses, profits, and tips. You can increase earned income by asking for a raise, finding a second job, or doing a side gig.

Passive Income

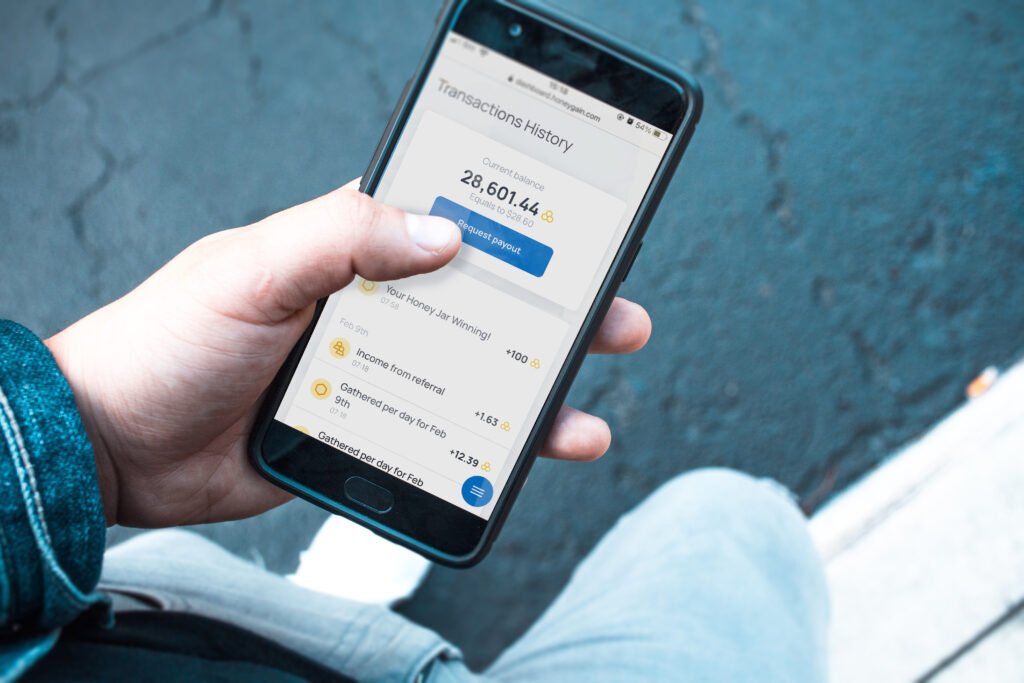

Passive income is money collected from businesses or investments that don’t require you to be actively involved. It includes rental property income, royalty payments, money earned from bandwidth sharing via passive income apps, and affiliate marketing commissions. You can combine different passive income ideas to make even more extra money.

Portfolio Income

Portfolio or investment income comes from the money you’ve put into financial assets. It includes interest, dividends, and capital gains. One way to up your investment income is by saving money in a money market account rather than a traditional savings account, as the former usually offers a higher interest rate. The rates are also commonly tiered, so the bigger your balance, the higher rates you earn.

Create a Personal Budget

A budget is a spending plan that dictates how much you will spend over a specific period, typically a month. Budgeting gives you control over your spending, helps you stay on track to reach your financial goals, prepares you for emergencies, and helps secure your retirement.

There are three basic steps for starting a budget:

- Calculate your net income.

- List your fixed and variable expenses.

- Subtract your expenses from your net income.

If it results in a budget deficit, i.e., a negative balance between your expenses and income, you’re living beyond your means. Examine your expenditure for things you can cut back on or eliminate. For instance, you could downsize your home and pay a lesser mortgage. If you stick with your budget, you’ll increase your chances of long-term financial security and stability.

Save and Invest

You can choose to either save or invest your budget surplus. Saving refers to putting money aside gradually, typically in a bank account. On the other hand, investing involves putting money to work to either generate income or increase the value of your investment.

Both strategies are crucial for accumulating money and achieving a comfortable financial future. However, depending on your financial situation, risk tolerance, and goals, saving may be better for your circumstances than investing, or vice versa.

For instance, if you don’t have an emergency fund, contributing towards one should take precedence over buying shares. Similarly, say you work for a company that will match the amount you contribute to your 401(k) up to a certain amount. Contributing enough money to get a match is a smart move. Otherwise, it’s like turning down free money.

It’s important to remember investing does not guarantee a return. There’s an ever-present risk of losing some or all of your money in a market downturn. For this reason, diversifying your assets is crucial, as investments perform differently during different economic times.

Start Today

To achieve financial security and build wealth, you should increase your assets and decrease your liabilities. Setting financial goals, creating a spending plan, regularly saving and investing, and increasing your income, will put you on track. The important thing is to start—and to start early.